tax refund calculator ontario 2022

This marginal tax rate means that your immediate additional income will be taxed at this rate. Prince Edward Island PEI.

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

You can claim the tax exemption if.

. To 6 pm ET Monday to Friday. 2022 Ontario Income Tax Calculator. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and. Start with a free eFile account and file federal and state taxes online by April 18 2022. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

The second tax bracket at 915 is increasing to an upper range of 90287 from the previous 89482. Finally earnings above 220000 will be taxed at a rate of 1316. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

Newfoundland and Labrador NL. We strive for accuracy but cannot guarantee it. After May 2 English and French hours of operation will be 9 am.

This is your net income before adjustments. The calculator reflects known rates as of June 1 2022. The amount the parent will pay in land transfer tax would be 64752 - 0 323750.

You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and provincial tax rates. Heres what you need to know. In other words the parent will be paying their full share of the land transfer tax while the childs portion of their interest in the home will be reduced by the tax refund amount.

For 2021 the non-refundable basic personal amount in Ontario is 10880 along with an extra tax reduction amount that Ontario provides to its residents. Calculate the tax savings your RRSP contribution generates in each province and territory. ET for French during tax season from February 22 to May 2 2022.

Your average tax rate is 270 and your marginal tax rate is 353. The tax rates for Ontario in 2021 are as follows. Mené lenquête Portrait de la société canadienne Répercussions de la hausse des prix du 19.

Calculate your combined federal and provincial tax bill in each province and territory. Calculations are based on rates known as of March 29 2022 and includes changes from the New Brunswick 2022 budget. 2022 Personal tax calculator.

That means that your net pay will be 40568 per year or 3381 per month. CAI Payment Amounts for Each Child Under 18 Starting With the Second Child for Single Parents for 2022-23. This way you can report the correct amounts received and avoid potential delays to.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The total Ontario land transfer tax would be 6475 - 2000 4475. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

For 2021 the basic personal amount is increasing to 10880. You are an eligible employer as defined under the EHT Act. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

Your average tax rate is 220 and your marginal tax rate is 353. 8 rows Income Tax Calculator Ontario 2021. If you paid less you may owe a balance.

Amounts above 45142 up to 90287 are taxed at 915. The calculator provides an estimate of your 2021 tax liability or refund based on the limited information you provide. Earnings 150000 up to 220000 the rates are 1216.

The Ontario Basic Personal Amount was 10783 in 2020. How calculate property taxes for 2021 tax return Ontario Property Tax Benefit Taxes. Amounts 90287 up to 150000 the rate is 1116.

This marginal tax rate means that your immediate additional income will be taxed at this rate. This means the federal basic personal amount will increase to 14398 138081025 in 2022. Amounts do not reflect the 10 per cent supplement for residents of small and rural communities.

Referred to as a qualified relation in the legislation. The amount of taxable income that applies to the first tax bracket at 505 is increasing from 44740 to 45142. Ive completed all of my 2021 tax return I know - late except for the Trillium benefit section - which I believe relates to Property Tax expenditures.

Total for 2022-23. Reflects known rates as of January 15 2022. Amounts earned up to 45142 are taxed at 505.

Calculations are based on rates known as of october 28 2021. This calculator is for 2022 Tax Returns due in 2023. There is also a.

2022 RRSP savings calculator. Use our free 2022 Ontario income tax calculator to see how much you will pay in taxes. That means that your net pay will be 37957 per year or 3163 per month.

Carrying charges and interest expenses attach Schedule 4 Deduction for CPP or QPP contributions on self-employment and other earnings attach Schedule 8 or Form RC381 whichever applies Add lines 207 208 210 to 224 229 231 and 232. You pay income taxes. The provincial income tax rates in Ontario range from 505 to 1316.

If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. For 2014 2018 the tax exemption was 450000. Assumes RRSP contribution amount is fully deductible.

For 2019 Ontario provided EHT relief for small eligible employers through a tax exemption on the first 490000 of total Ontario payroll each year.

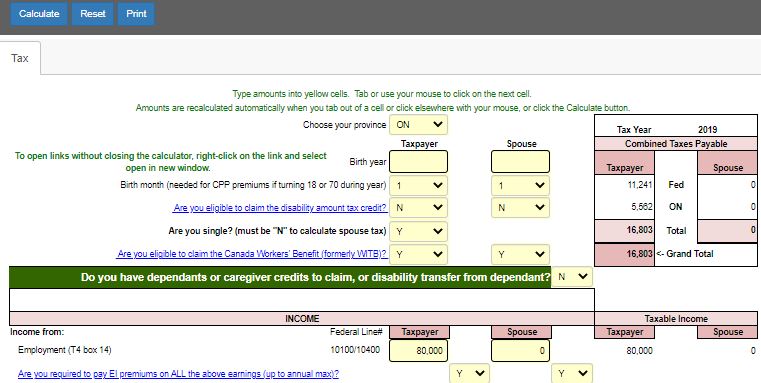

Taxtips Ca 2019 Canadian Income Tax And Rrsp Savings Calculator

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Calculate Income Tax In Excel

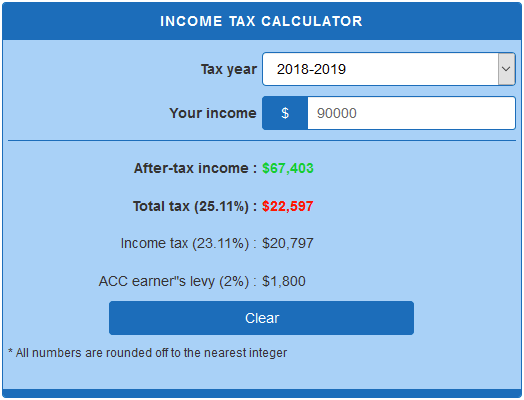

Australian Income Tax Calculator Calculatorsworld Com

Income Tax Calculator Calculatorscanada Ca

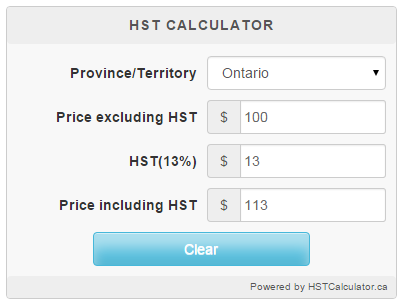

Ontario Hst Calculator 2020 Hstcalculator Ca

Excel Formula Income Tax Bracket Calculation Exceljet

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

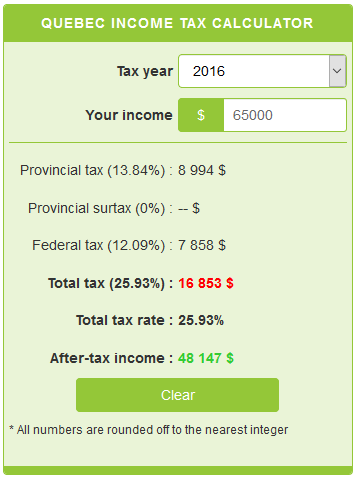

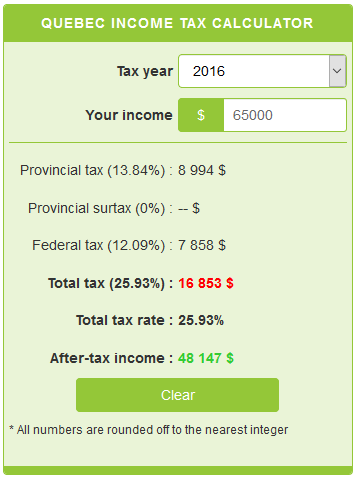

Quebec Income Tax Calculator Calculatorscanada Ca

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Gst Calculator Goods And Services Tax Calculation

Ontario Income Tax Calculator Calculatorscanada Ca

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

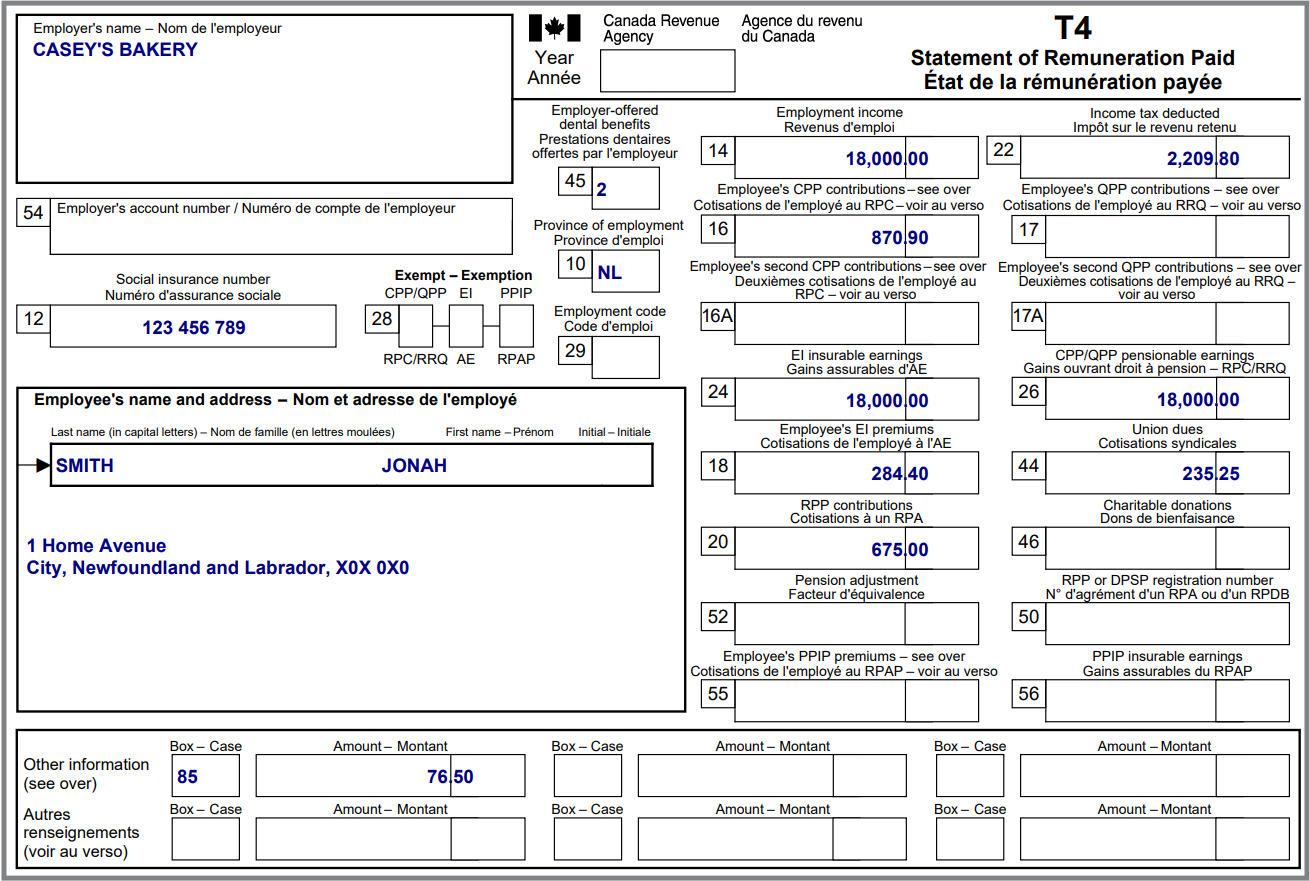

Exercise Calculate A Refund Or A Balance Owing Learn About Your Taxes Canada Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download